Boost Revenue with Improving Customer Lifetime Value Strategies

Improving customer lifetime value starts with a simple shift in thinking.Instead of viewing a customer relationship through the lens of a single sale, you need to see it as the total predicted revenue they'll generate over their entire time with your business. It's a long-term measure of a customer's total worth, and frankly, it's one of the most critical metrics for building a sustainable, profitable SaaS company.

Why CLV Is Your Most Important SaaS Metric

In the world of SaaS, we're swimming in acronyms—MRR, ARR, CAC. While they all have their place, Customer Lifetime Value (CLV or LTV) is in a league of its own. Think of it as your north star metric. It doesn't just tell you how you're doing today; it forecasts the long-term health and resilience of your entire business.

Focusing on CLV forces you to move beyond the transaction and build real, lasting relationships.

This shift in perspective changes everything. You stop pouring resources into a leaky bucket of one-time customers and start investing in strategies that keep them around longer and, ideally, increase their spending over time. That's the whole game right there.

Of course, to improve CLV, you have to start with a solid foundation. That means getting the right customers in the door from day one. Building an automated lead generation system is crucial because it ensures you're attracting customers who are a good fit—the kind more likely to become valuable, long-term partners.

To really get a handle on CLV, you need to understand the levers that move it. Let's pull back the curtain on the key metrics that power your customer lifetime value and see how they work together.

Key Metrics Driving Your Customer Lifetime Value

| Metric | What It Measures | Why It's Important for SaaS CLV |

|---|---|---|

| Average Revenue Per Account (ARPA) | The average revenue you generate from each customer, typically on a monthly or annual basis. | Increasing this through upgrades, add-ons, or tiered pricing directly boosts the "value" part of CLV. |

| Customer Lifespan | The average length of time a customer remains a paying subscriber to your service. | The longer a customer stays, the more revenue they generate. This is the "lifetime" component of the equation. |

| Customer Churn Rate | The percentage of customers who cancel their subscriptions within a specific time period. | This is the enemy of a long customer lifespan. Reducing churn is the most powerful way to extend lifespan and grow CLV. |

These components aren't just abstract numbers; they have a real, tangible impact on your bottom line.

Imagine you run a project management SaaS with an ARPA of $50/month. If your average customer sticks around for 24 months, their CLV is a respectable $1,200.

But what if you could extend that lifespan to 36 months just by reducing churn? Suddenly, that same customer's CLV jumps to $1,800. That's a massive 50% increase without spending a single extra dollar on acquiring a new customer.

Calculating Your Customer Lifetime Value

Figuring out your CLV can be simple or incredibly complex, but the basic formula is a great starting point. At its core, CLV is often calculated by multiplying three key metrics: Average Order Value (AOV), Purchase Frequency, and Customer Lifespan.

A classic example might look like this: a customer with an AOV of $72 who purchases 3 times a year for an average of 7 years has a CLV of $2,016.

However, more sophisticated SaaS models will incorporate other crucial factors like retention rates, churn, and discounting future revenues to get a more accurate picture of lifetime profit. You can find more in-depth breakdowns of these calculations over at CMSWire.com.

The real power of CLV isn't just in the number itself, but in the strategic questions it forces you to ask. It shifts the conversation from 'How do we get more customers?' to 'How do we create more value for our existing customers?'

Building a Retention Engine to Boost CLV

Chasing new customers always feels like a victory, but the real secret to sustainable growth? It's all about keeping the customers you already have. Retention is easily the most powerful lever you can pull to improve customer lifetime value. This isn't just about keeping people happy; it's about building a systematic engine that actively protects and nurtures your customer base.

When you start prioritizing retention over acquisition, the financial impact is almost immediate and undeniable. Here's a stat that always gets my attention: increasing customer retention by just 5% can rocket profits by an incredible 25% to 95%. That massive range shows exactly why pouring resources into your existing customers pays off so handsomely.

To really move the needle on CLV, mastering effective customer retention management is non-negotiable. This means getting out of the reactive support-ticket mindset and building a proactive system that actually anticipates what your customers need to succeed.

Proactive Customer Success Tactics

A strong retention engine is built on one thing: proactive engagement. You simply can't afford to wait for a customer to send up a flare. By the time they do, their frustration is already boiling over, and their loyalty is on shaky ground. A proactive approach is all about spotting and solving problems before they even become problems.

One of the most crucial stages for this is right at the beginning—onboarding. A slick, personalized onboarding experience sets the entire tone for the customer relationship. It’s your first and best shot to prove your value and get users to that "aha!" moment where your product's benefit really clicks for them. We have a whole guide on powerful customer onboarding strategies to help you nail this from day one.

Beyond onboarding, you should be thinking about these kinds of tactics:

- Regular Health Checks: Don't wait for the annual renewal to see how things are going. Set up a system for regular account health checks, keeping a close eye on key usage metrics to spot any dips in engagement. A customer who stops using a core feature is a silent churn risk.

- Targeted Education: Use your product data to find customers who aren't using valuable features. Send them super-targeted emails, in-app guides, or even webinar invites that show them exactly what they're missing and how to get more value.

- Value-Based Communication: Ditch the generic newsletters. Instead, send communications that highlight the value they’ve already gotten. Imagine a monthly summary email that says, "This month, you automated 50 reports, saving an estimated 10 hours of manual work." That’s powerful stuff.

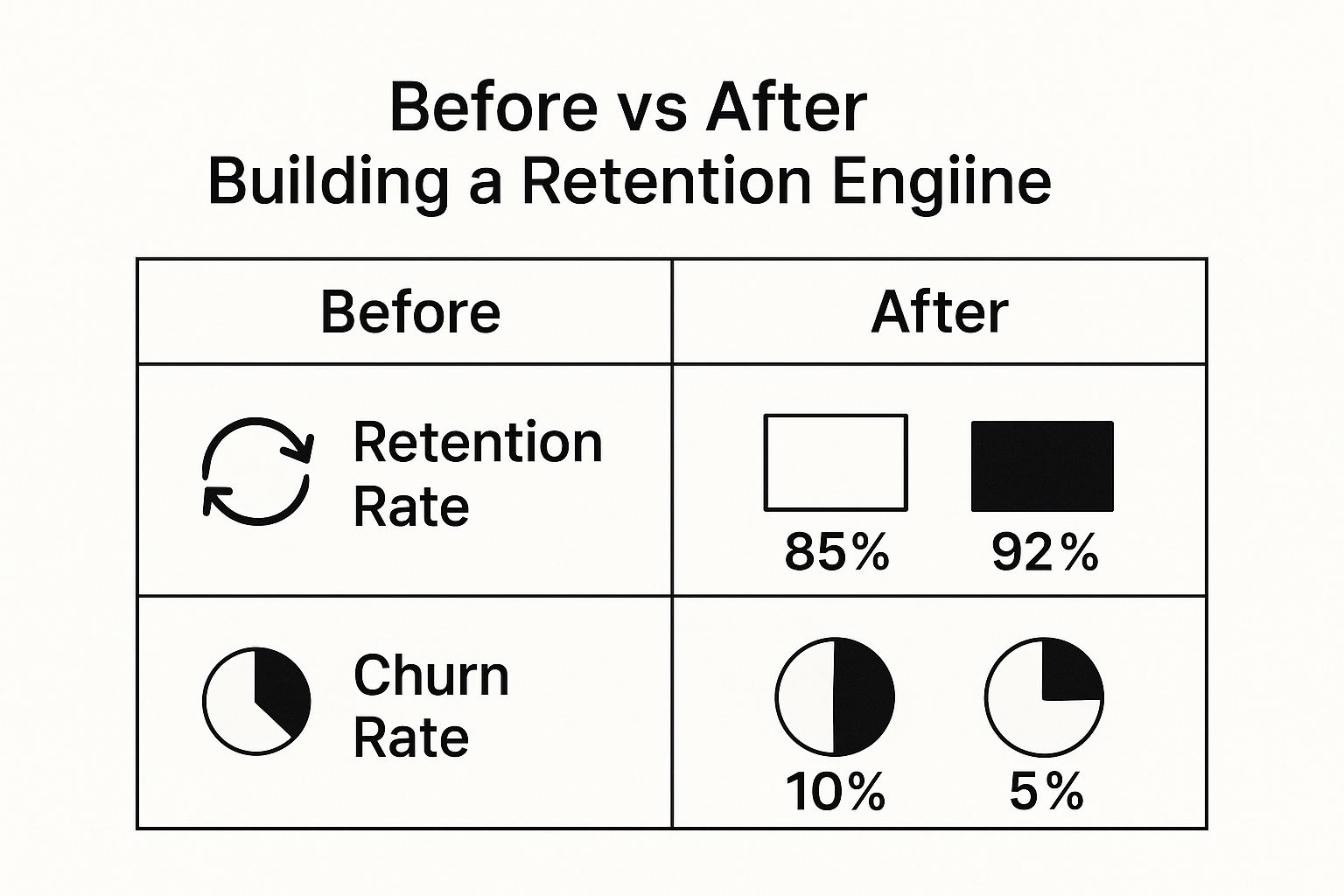

The infographic below really drives home the shift in key metrics after putting a dedicated retention engine in place.

As you can see, a focus on retention can literally cut churn in half while dramatically boosting your overall retention rate. That’s a direct pipeline to a higher CLV.

Creating a Powerful Feedback Loop

Your customers want to feel like you're listening. Building a transparent and responsive feedback loop is how you make them feel less like subscribers and more like partners in your product’s journey. When people see their suggestions actually get implemented, it builds an incredible amount of loyalty and makes them feel truly invested.

A simple "suggestion box" just doesn't cut it anymore. You need a structured system to collect, acknowledge, and, most importantly, act on customer feedback.

A great feedback loop does more than just collect ideas; it closes the loop. It communicates back to the customer that their voice was heard and their input led to real change, transforming them from a user into a genuine advocate.

For example, let's say a project management SaaS gets a ton of requests for a specific integration. Instead of just adding it to a massive backlog, they could:

- Acknowledge It Publicly: They could set up a public feature request board where users can upvote ideas. This creates transparency and helps the team prioritize what to build next.

- Provide Updates: They can tag the users who requested the feature in updates like, "Good news! This is now in development," or "Beta testers wanted!"

- Celebrate the Launch: When the feature goes live, they should personally email every single user who asked for it, thanking them for their input.

This whole process delivers more than just a new feature; it delivers an experience that reinforces the customer's decision to choose your product. It’s a killer retention tool that shows you’re listening and evolving right alongside their needs—which is what growing customer lifetime value is all about.

Mastering Upsell and Cross-Sell Opportunities

Retention is all about protecting the revenue you already have, but real, sustainable growth? That comes from expanding it. Making the shift from just preventing churn to actively growing revenue from your existing customers is a massive step in boosting customer lifetime value. This is where a smart upsell and cross-sell strategy becomes your most valuable playbook.

People often use upselling and cross-selling interchangeably, but they're two distinct plays. Upselling is about convincing a customer to upgrade to a more powerful, premium version of the product they're already using. Cross-selling, on the other hand, is about offering a related but separate product that complements what they have.

Making either of these work isn't about pushing a hard sell. It’s about deeply understanding your customers—knowing that perfect moment to present an offer that feels less like a sales pitch and more like a genuinely helpful solution.

Identifying the Perfect Upgrade Moment

Timing is absolutely everything. A poorly timed offer feels pushy and can break trust, but a well-timed one makes it seem like you're reading the customer's mind. The secret is to watch for specific behavioral triggers inside your product.

These triggers are basically flashing signs that a customer is outgrowing their current plan and is ready for more.

- Hitting Usage Limits: This is the most obvious signal. When a user keeps bumping up against their storage cap, user seat count, or API call limit, it’s a natural and compelling reason to show them the next tier.

- Exploring Advanced Features: If a customer on a basic plan is constantly clicking on features locked behind a paywall, they're literally telling you what they want. Smart in-app prompts can guide them toward a plan that unlocks that exact functionality.

- Demonstrating Success: A customer whose engagement is through the roof is a prime candidate for an upsell. They're clearly getting tons of value from your tool and are far more likely to invest more to get even better results.

Imagine a social media scheduling tool. A user on the "Solo" plan tries to add a second team member and hits their limit. An automated in-app message could pop up: "Looks like your team is growing! Upgrade to our 'Team' plan to add more users and unlock collaboration features." It's timely, relevant, and genuinely helpful.

The goal is to frame the upsell not as a cost, but as an investment in the customer's own success. You're not asking for more money; you're offering them the tools to solve a new, bigger problem they're facing because they've grown.

Delivering Relevant Cross-Sell Offers

While upselling moves customers up your existing product ladder, cross-selling expands their toolkit with new, complementary solutions. This makes your product "stickier" and embeds it deeper into their daily workflow. A great cross-sell is all about relevance.

The offer has to solve an adjacent problem your customer is probably struggling with. A generic, one-size-fits-all email blast will just get ignored. You have to segment your customers to deliver offers that feel like they were made just for them.

To help you decide which path to take, here’s a quick breakdown of when to use each strategy.

Upsell vs Cross-Sell: When to Use Each Strategy

| Strategy | Primary Goal | Ideal Customer Signal | SaaS Example |

|---|---|---|---|

| Upsell | Increase ARPA by moving a user to a higher-tier plan. | User frequently hits usage limits or explores locked features. | A project management tool suggests upgrading to a plan with more storage and advanced reporting. |

| Cross-Sell | Increase product stickiness and solve an adjacent customer need. | User completes a specific workflow or integrates with a related service. | An email marketing platform offers a new, separate landing page builder to customers who regularly create campaigns. |

As you can see, each approach serves a different purpose but ultimately leads to a higher LTV.

A crucial piece of this puzzle is your pricing structure. It has to clearly support these expansion paths. If you want to go deeper on structuring your tiers for growth, our guide on a sample pricing model lays out some fantastic frameworks.

Let’s take an accounting software company. They might notice that a huge chunk of their small business users also struggle with creating professional invoices. Instead of cramming invoicing features into every plan and bloating the product, they could build a separate, lightweight invoicing tool. Then, they could offer it as an affordable add-on to customers who generate a certain number of client reports each month, solving a real problem and opening up a new revenue stream.

By using customer behavior data to pinpoint these opportunities, you stop guessing and start turning insights into predictable revenue—a massive step toward improving customer lifetime value.

Driving Engagement and Customer Loyalty

Loyalty is the final frontier in boosting customer lifetime value. It’s where you transform a functional, transactional relationship with a user into a genuine partnership. This goes way beyond just making customers happy; it’s about forging a connection so strong that they wouldn't even think about jumping ship to a competitor, no matter the price difference.

Modern SaaS loyalty isn’t built on flimsy point systems or cheap discounts. It's forged through delivering real, tangible value. Think less about collecting points and more about providing meaningful rewards that deepen a customer's investment in your product and your success.

The screenshot above from a Pages.Report dashboard is a perfect example of how you can get a clear view into this. By keeping a close eye on engagement metrics, you can literally see how users are interacting with your platform, which helps you spot opportunities to strengthen their commitment long before they become a churn risk.

This creates a powerful, self-reinforcing cycle. High engagement fuels loyalty, which in turn drives a much higher CLV.

Redefining SaaS Loyalty Programs

Forget the old-school punch-card mentality. The loyalty and advocacy programs that actually work in B2B SaaS are built on exclusivity and real value, not just another 10% off. The goal here is simple: make your best customers feel like true insiders.

Here are a few value-based rewards that really resonate with customers:

- Early Access to New Features: Let your most loyal customers get a sneak peek at beta features. This not only makes them feel special but also gives you invaluable feedback from your most engaged, power users.

- Exclusive Content and Training: Offer up access to advanced webinars, private workshops, or deep-dive strategy guides that aren't available to just anyone. You're rewarding them with knowledge that directly helps them succeed.

- Premium Support Tiers: Automatically upgrade long-term customers to a higher support tier with faster response times or even a dedicated account manager. This is a tangible reward that shows you value their business.

These strategies do more than just keep customers around; they start the process of turning your happy users into powerful brand advocates who will sing your praises.

True loyalty isn't transactional; it's relational. It's the moment a customer stops seeing you as a vendor and starts seeing you as an indispensable partner in their own success.

This mindset shift is absolutely critical for any kind of long-term, sustainable growth. In fact, investing in these programs is quickly becoming a standard business practice. The global loyalty management market was valued at $13.31 billion and is projected to skyrocket to $41.21 billion by 2032—that’s a compound annual growth rate of 15.3%.

This explosive growth shows just how seriously companies are taking this. You can find more insights on this trend and evolving customer expectations on Antavo.com.

Measuring Engagement Metrics That Matter

You can't improve what you don't measure. If you want to build loyalty, you have to track engagement with metrics that go way beyond simple logins. These data points tell the real story of just how embedded your product is in a customer's day-to-day workflow.

- Feature Adoption Rate: Are your customers actually using the powerful, high-value features you've spent months building? A low adoption rate for a key feature is a major red flag that they aren't getting the full value they could be.

- Daily Active Users (DAU) / Monthly Active Users (MAU): This ratio is a classic "stickiness" metric for a reason. A high DAU/MAU ratio means customers are making your product a regular part of their daily routine, which is one of the strongest indicators of loyalty you can find.

- Session Duration and Frequency: How long are users staying in your app, and how often are they coming back? Longer, more frequent sessions suggest deep engagement and a real reliance on your tool to get their work done.

These are the metrics that give you the insights you need to be proactive. If you see a key customer's feature adoption starting to dip, you can reach out with some targeted educational content before they ever become a churn risk.

Building a Thriving Community

Finally, one of the most powerful loyalty drivers you can build is a sense of community. B2B SaaS companies that create thriving communities give their customers a space to connect, share best practices, and learn from one another. This transforms your product from just another standalone tool into a central hub for their professional lives.

A strong community doesn't just retain customers; it creates a powerful network effect. New users are drawn in by the collective knowledge and support of your existing members. This ecosystem of advocates quickly becomes one of your most effective, organic marketing channels, dramatically improving customer lifetime value by attracting and retaining high-quality users for you.

Using Data to Operationalize Your CLV Strategy

All the strategies we've talked about—from retention engines to loyalty programs—run on a single, powerful fuel: data. Without a clear way to measure what you’re doing, you’re just guessing. This is where we stop theorizing and start building a system that actively works to improve customer lifetime value.

The goal is to shift from just knowing your CLV to operationalizing it. That means creating a central hub to monitor the health of your customer base and using those insights to fire off specific, automated actions that drive real growth.

Building Your CLV Command Center

You can't manage what you don't measure. The first step is to build a simple, focused dashboard that gives you an at-a-glance view of your most important CLV metrics. This isn’t about tracking every possible data point; it’s about honing in on the vital few that have a direct impact.

Your command center should put these core metrics front and center:

- Customer Retention Rate: The percentage of customers who stick around over a given period. This is your primary defense against churn and the bedrock of a high CLV.

- Expansion MRR: All the additional monthly recurring revenue you're generating from existing customers through upsells, cross-sells, and add-ons. This is your active growth engine.

- Customer Engagement Score: A combined score that measures how people are using your product—think feature adoption, session frequency, and daily active users. This is your early warning system for churn.

- CLV to CAC Ratio: The ultimate health check. A healthy ratio, ideally 3:1 or higher, confirms that your business model is actually profitable and sustainable.

Having these numbers in one place lets you see the direct results of your efforts. For example, if you launch a new onboarding flow, you should see a corresponding lift in your engagement score and, down the line, your retention rate. That visibility is what lets you make smart, informed decisions.

Segmenting Customers for Targeted Action

With your key metrics in place, the next move is to slice up your user base based on their CLV potential. Let's be honest, not all customers are created equal. Some have a much higher potential to grow, while others are at risk of churning out. Using data to identify these groups lets you tailor your actions for maximum impact.

The best CLV strategies don't treat every customer the same. They deliver personalized experiences based on where someone is in their journey and what their behavior tells you they need next.

You can create dynamic segments right in your analytics tool based on specific behaviors and value. Here’s a practical framework to get started:

- High-Potential Champions: These are your power users. They have high engagement scores and a history of jumping on new features. They are prime candidates for upsells and invitations to your beta programs. The goal here is to nurture them into full-blown advocates.

- Stable and Satisfied: This group uses your product consistently but probably isn't exploring its full potential. They're perfect for targeted cross-sell campaigns or educational content that introduces them to adjacent features, making your product even stickier for them.

- At-Risk Accounts: These are the users showing declining engagement—fewer logins, lower feature adoption, or they've just gone quiet. You need to trigger automated re-engagement campaigns, offer a one-on-one with customer success, or send a survey to find their pain points before it’s too late.

This level of segmentation is a core piece of any effective, data-driven marketing plan. To really dig into this, check out our guide on implementing data-driven marketing strategies for your SaaS.

Triggering Personalized Campaigns

The final step is connecting your data insights to automated actions. This is where you truly put your CLV strategy to work. By setting up triggers based on your segments and metrics, you can deliver the right message at the perfect moment—without lifting a finger.

For instance, if a user in your "High-Potential Champions" segment clicks on a premium feature they don’t have access to, a trigger can automatically send them a personalized email. The message could offer a limited-time trial of the next-tier plan, directly addressing the interest they just showed you.

Likewise, if an account's health score drops into the "At-Risk" category, it could automatically create a task for your customer success team to reach out personally. This proactive approach turns your data into a powerful, automated engine for retention and growth, essentially putting your CLV strategy on autopilot.

Your Top CLV Questions, Answered

As you start putting these CLV strategies into play, you’re bound to run into a few common questions. Getting these details ironed out is what turns a good plan into a great one. Let’s tackle the ones I hear most often from SaaS founders.

How Often Should a SaaS Business Calculate CLV?

For most established SaaS companies, running the numbers on CLV quarterly hits the sweet spot. It's frequent enough to show you how your recent efforts are paying off—like that new retention campaign or a pricing tweak—without getting bogged down by the random noise of day-to-day fluctuations.

But that’s not a hard-and-fast rule. If you're a high-growth startup or in the middle of a major product overhaul, switching to a monthly calculation can give you the rapid feedback you need to pivot quickly.

The most important thing? Consistency. Whatever cadence you choose, stick to it. That’s the only way you’ll be able to spot real trends and understand if your strategies are actually working.

What Is a Good CLV to CAC Ratio?

This is the big one. For a healthy SaaS business, you should be aiming for a CLV to Customer Acquisition Cost (CAC) ratio of 3:1 or higher. Plain and simple, that means for every dollar you burn to get a new customer, you should make at least three dollars back over their lifetime.

A ratio sinking below 3:1 is a red flag. It might mean your marketing spend is inefficient, or your product isn't sticky enough to keep customers around long enough to recoup acquisition costs. It's a critical health metric for your entire business model.

On the other hand, if your ratio is sky-high—say, 5:1 or more—it might actually mean you're playing it too safe. A ratio that healthy is a strong sign you could be investing more aggressively in your marketing and sales channels to capture more of the market without wrecking your unit economics.

Can CLV Be Improved for Customers on a Legacy Plan?

Absolutely, and it’s a mistake to think otherwise. Many founders see customers on old "grandfathered" plans as a fixed asset, but you have more levers to pull than you think.

While you probably can't just hike their subscription price, you can still significantly boost their lifetime value.

- First, double down on exceptional service. Your number one goal here is retention. Keeping these loyal customers happy maximizes their lifespan, which directly pumps up their CLV. A happy legacy customer is always better than a churned one.

- Next, look for smart cross-sell opportunities. Do you have a new add-on or a complementary product that solves another one of their problems? This is a fantastic way to increase their total spend without touching their core plan.

- Finally, create a compelling migration path. Don’t force them off their old plan. Instead, build an attractive offer that highlights overwhelming new value, making the upgrade a no-brainer. These long-time customers can also be your best source of high-quality referrals, which adds another layer of value.

Ready to turn these insights into action? Pages.Report gives you access to proven patterns from over 368 successful SaaS products, helping you optimize your landing pages to attract and retain high-value customers from day one. Start building a stronger foundation for your CLV at https://pages.report.