Build a Winning Competitive Comparison Chart

Let's be honest, your prospects are already sizing you up against the competition. A smart competitive comparison chart doesn't just get you in the conversation—it lets you lead it. By visually organizing key features, pricing, and benefits, it becomes one of your most valuable sales and marketing assets.

How Comparison Charts Drive SaaS Growth

In the crowded SaaS space, prospects are drowning in options. They’re making mental (or actual) checklists to justify their final decision to the rest of their team. A competitive comparison chart meets them right where they are in that process, giving them the clarity they need to pick you.

This isn't about bad-mouthing your competitors. It's about confidently framing the narrative.

When you present this information openly, you build instant trust. Instead of making a prospect hunt through five different websites to piece everything together, you hand them a clear, side-by-side view that respects their time. That simple act can slash your sales cycle by answering the biggest questions right away.

Aligning Teams and Strategy

The perks go way beyond just converting leads. Internally, a well-researched chart is the single source of truth for your sales and marketing folks. It gets everyone on the same page about your core differentiators and arms them with consistent, powerful talking points.

To really get the most out of these charts, they need to be a core part of your wider strategy. Weaving them into a holistic B2B SaaS Marketing Strategy Playbook is essential.

A great comparison chart does more than just list features. It tells a story about why your solution is the right choice for a specific customer, turning a simple grid into a powerful persuasion tool.

Positioning as the Obvious Choice

This is where a competitive chart really flexes its muscles. Just look at the search engine market. For over a decade, Google has held a staggering 90.38% of the global market share, while Bing sits at a distant 4.1%. A chart showing that gap would instantly frame Google as the undisputed leader.

This infographic breaks down how a chart drives growth by building trust, shortening the sales cycle, and positioning your product as the clear winner.

Each step here reinforces the value you bring to the table, steering prospects toward a confident "yes."

Gathering Your Competitive Intelligence

A killer competitive comparison chart is built on solid research, not guesswork. Before you even touch a spreadsheet, you need to dig deep into what’s happening in your market to find the insights that actually matter to your customers. This is about going way beyond a surface-level feature list to understand the why behind every purchase.

To build a chart that wins deals, you have to first master what competitive intelligence entails and how it shapes your strategy. It’s the difference between a chart that just lists things and one that tells a story your prospects can’t ignore.

Identifying Your True Competitors

First things first, you need to know who you’re actually up against. It’s almost never just the one or two big names that immediately come to mind. I find it helpful to think about competitors in three distinct buckets to get the full picture.

- Direct Competitors: These are the obvious ones—the companies offering a very similar product to the same audience. They solve the exact same problem you do, and your prospects are definitely looking at you side-by-side.

- Indirect Competitors: These folks solve the same core problem, but they do it with a totally different type of solution. For a project management tool, this could be something as simple as a shared spreadsheet or even a well-organized Notion doc.

- Emerging Competitors: These are the new kids on the block. They’re often smaller, maybe targeting a specific niche within your market with a fresh angle. It’s a huge mistake to ignore them; they can gain ground faster than you think.

Once you’ve got a list, fire up some of the best competitor analysis tools to automate some of the grunt work. They can help you track their marketing, keyword strategy, and content moves without you having to do it all by hand.

Moving Beyond the Feature Checklist

Here’s where most companies go wrong. They just copy and paste features from a competitor's pricing page and call it a day. That’s a recipe for a generic, unconvincing chart that nobody cares about.

The real gold is buried in the qualitative data—the actual voice of the customer. This is where you uncover the nagging pain points and the "aha!" moments that really drive a decision. Your goal is to figure out what customers actually care about.

The most powerful comparison points aren't just about what a product does, but how it makes a customer feel. Does it save them time? Reduce frustration? Make them look good to their boss? That's the intelligence you need.

To get this kind of deep insight, you need to become a detective. Tap into these sources:

- Customer Review Sites: Platforms like G2, Capterra, and TrustRadius are absolute treasure troves of honest, unfiltered feedback. Look for patterns in both the 5-star and 1-star reviews for your competitors. What do users consistently praise or complain about?

- Sales Call Recordings: Your sales team is on the front lines, hearing it all. Listen to their call recordings and pay super close attention to the questions prospects ask about competitors and the objections they raise. These are direct clues about their evaluation criteria.

- Support Tickets: Dig into your own support tickets. If you can, check out public forums for competitors, too. What issues are causing the most headaches? A competitor might technically have a feature, but if it’s poorly implemented and a constant source of user frustration, that’s a massive weak spot you can highlight.

Establishing Your Core Narrative

After all this digging, you can finally define your chart’s core narrative. This is the single, overarching message that every single checkmark and data point on your chart should support. You can't be the best at everything, so you have to decide on your strategic angle.

Are you the easiest-to-use option for non-technical teams? The most powerful and scalable solution for enterprises? Or maybe you're the best bang for the buck for small businesses on a tight budget?

For example, let's say your research reveals that your main competitor is powerful but notoriously complicated to set up. Your narrative could be something like, "The Powerful Alternative That's Ready in Minutes." Every feature comparison you list should then tie back to this core theme of simplicity and speed, creating a coherent and compelling argument for why you’re the obvious choice for your ideal customer.

Choosing the Right Features to Compare

Okay, you've done the digging and have a pile of competitive intel. Now comes the fun part: turning that raw data into a visual story that actually persuades people. Deciding which features to showcase is a delicate balancing act. You need to highlight your strengths without coming off as biased, guiding your prospect to a conclusion that feels like their own discovery.

Let's be clear: the goal is not to list every single function your product has. That’s how you get an overwhelming, cluttered chart that people will bounce from in seconds. Instead, you're curating a selection of comparison points that speak directly to the core problems your ideal customer is trying to solve.

Start with Customer-Centric Categories

Before you even think about individual features, group them into categories that make sense to a buyer. This simple step makes your chart scannable and helps prospects find what matters to them, fast. Ditch the internal jargon and think in terms of value.

Here are a few categories that almost always work for SaaS comparison charts:

- Core Functionality: These are the non-negotiables, the must-haves that solve the main pain point. For a project management tool, this might be "Task Dependencies" or "Gantt Charts."

- Integrations: How well do you play with the other tools your customers already use day-in and day-out? List the big ones like Slack, Salesforce, or Google Drive.

- Support & Onboarding: What happens when your customer needs help? This covers everything from live chat availability to whether they get a dedicated account manager.

- Pricing & Tiers: Be upfront about the cost. Even if you have to use general terms like "Usage-Based" vs. "Per-Seat," addressing price is crucial for building trust.

Structuring your chart this way shifts the conversation from a simple feature checklist to a more compelling discussion about broad value propositions. It's a much more effective way to tell your story.

The Art of Honest Framing

Your most powerful sales tool here is honesty. Prospects are smart; they can spot a biased, misleading chart from a mile away, and it will torpedo your credibility. This is where "honest framing" comes in. It’s about presenting the data truthfully while still ensuring your product shines.

This means you don't have to "win" on every single row. In fact, admitting a competitor has a specific strength can make your own advantages seem far more believable.

Admitting a competitor has a niche feature you don't can build immense trust. You can frame it honestly, such as marking it as available for them, while your product's strengths in core areas still make it the superior overall choice for your target audience.

For example, let's say a competitor has an incredibly advanced feature that only 5% of the market truly needs. You can include it. But frame it in a way that subtly highlights your focus on the features 95% of users actually need to get their job done. You acknowledge their strength but immediately pivot back to a story that benefits you.

Choosing the Right Chart Format

The standard grid isn't your only play. The format of your competitive comparison chart should serve your core narrative, and different layouts can emphasize different strengths.

While some tech markets are highly concentrated, many others are not. The global smartphone market, for instance, shows how different leaders adapt their strategies to varied conditions, with no single company enjoying total dominance. You can learn more about the competitive dynamics in the global smartphone market. This diversity means a one-size-fits-all comparison approach rarely works.

Before you default to a standard grid, it's worth exploring a few different structures to see which one tells your story most effectively. Each format has its own strategic sweet spot.

| Chart Type | Best For | Key Advantage | Potential Pitfall |

|---|---|---|---|

| Classic Grid | A direct, feature-by-feature comparison against 1-3 key competitors. | Clear, scannable, and familiar to most buyers. Excellent for head-to-head battles. | Can feel overwhelming if too many features or competitors are included. |

| Tiered Table | Comparing your own plans ("Good, Better, Best") against a competitor's single offering. | Visually guides the user toward a specific tier that offers the best value proposition. | Less effective if your pricing model is radically different from the competition's. |

| Use-Case Driven | Organizing the comparison around specific jobs-to-be-done. | Connects features directly to real-world value and pain points. | Requires a deep understanding of customer workflows to execute well. |

| Feature Deep Dive | Dedicating a smaller, focused chart to a single killer feature where you are superior. | Allows you to go into more detail and highlight a key differentiator without clutter. | Only works if you have a true "hero" feature that warrants its own spotlight. |

Ultimately, the right format is the one that makes it easiest for your ideal customer to see why your solution is the best fit for them.

By carefully curating your features, grouping them logically, framing them with integrity, and picking the right visual format, you create a comparison chart that doesn't just inform—it closes deals.

Designing a Chart That Persuades

Great design isn't just about making things look pretty; it's about steering your prospect toward the right conclusion. A cluttered, confusing, or untrustworthy comparison chart can kill a deal on the spot. Your goal is to create a visual experience that’s clear, compelling, and builds absolute confidence in your solution.

Effective design respects your reader's time. They should be able to scan your chart in seconds and immediately get your core value prop. This means prioritizing clarity over cramming in every single feature you can think of.

Establish a Clear Visual Hierarchy

Visual hierarchy tells the reader what to look at first. Without it, your chart is just a wall of data. Your company's column needs to stand out, but subtly. You don't want to look obviously biased, but you absolutely want to draw the eye.

A common tactic is placing your product in the first or second column and giving it a slightly different background color or a bolder header. This creates a focal point without being aggressive. Remember, the goal is to make your solution the anchor of the entire comparison.

Use Color and Icons Strategically

Color is a powerful communication tool. Use your brand’s primary color to highlight your column or key advantages. Keep your competitors in a neutral gray to create a natural contrast. A word of warning, though: avoid using big red "X" marks for competitors' missing features. It can come across as overly aggressive and a bit petty.

Icons are your best friend for quick comprehension.

- Checkmarks (✓): Universally understood for "Yes, we have this." Use a bold or branded color for your own checkmarks to make them pop.

- Dashes (–) or Empty Cells: A much more neutral way to show a feature is absent for a competitor. It’s less confrontational than a red X.

- Informational Icons (i): Perfect for features that need a bit more context. A user can hover over the icon to get a tooltip with a brief explanation.

These small visual cues make your chart incredibly scannable, especially for users on mobile who are quickly scrolling for info. Well-executed visuals are a core part of strong user experience design patterns, which can make or break your site's usability.

A successful chart doesn’t just show data; it tells a story. Every design choice, from the color of a checkmark to the font weight of a header, should reinforce the narrative that your product is the ideal solution for the reader's problem.

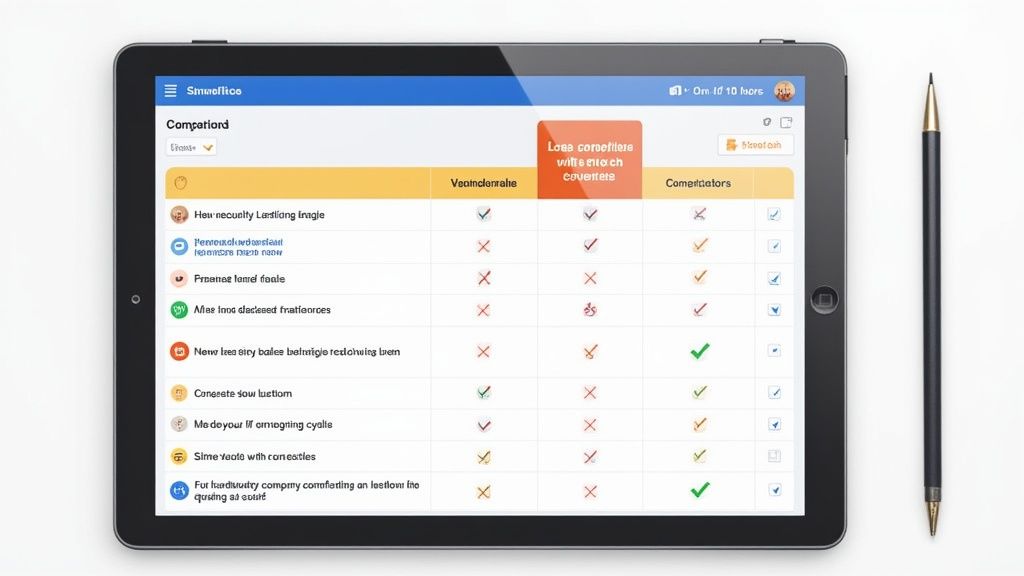

Take a look at how Monday.com designs its chart comparing their solution to Asana.

Notice how Monday.com uses its brand color for the checkmarks in its own column, creating an immediate visual pull. This subtle reinforcement guides the user’s eye and strengthens their brand association with all the positive features.

Write Copy That Sells Benefits, Not Just Features

The words you use are just as important as the design. Prospects don't care about technical jargon; they care about what your product can do for them. You need to frame every feature as a direct benefit.

Instead of a feature like "API Access," rephrase it as "Connect Your Favorite Tools." Instead of "Role-Based Permissions," try "Secure Team Collaboration." This benefit-focused language connects your product's capabilities directly to your user's goals and pain points.

Keep descriptions short and punchy. Each row should be scannable. If a feature really needs more explanation, link out to a dedicated landing page or a help doc. The chart's job is to give a high-level overview, not an exhaustive technical manual. This makes the information digestible and encourages genuinely interested prospects to dig deeper.

How to Promote Your Comparison Chart

Look, creating a killer competitive comparison chart is a massive win. Pat yourself on the back. But if that brilliant new asset just sits collecting digital dust on some forgotten corner of your website, it's not going to drive leads or close any deals.

Getting a real return on all that hard work comes down to a smart, multi-channel promotion strategy. This isn't about just blasting a link into the void. It’s about strategically placing your chart directly in the path of prospects who are deep in their decision-making process, right when they need it most.

Optimize for High-Intent Search Traffic

SEO is easily one of the most powerful ways to get your chart working for you. Prospects actively searching for comparisons are high-intent buyers—they're often just one step away from pulling out their credit card. Your job is to make sure they find your chart first.

The best way to do this is by creating a dedicated landing page for your chart. Optimize it for search terms like "[Your Brand] vs [Competitor]" or "[Competitor] alternatives." These are the exact phrases people use when they’re already familiar with the key players and just want a direct, feature-by-feature breakdown.

When you own this search traffic, you get to control the narrative and frame the comparison on your terms. This is a fundamental tactic, but if you want to go deeper, you can explore other proven ways to increase your website traffic through smart content strategies.

Weave It into Your Content Ecosystem

Your comparison chart shouldn't be a standalone island. For it to be truly effective, you need to integrate it deeply into your existing content to add value and guide prospects through their journey.

Here are a few simple ways to embed it:

- Blog Posts: Mention a key differentiator and link back to the full chart. For instance, in a post about a new feature, you could write, "While some tools lack this capability, we designed ours for X. See exactly how we stack up in our full comparison."

- Guest Articles: When you're writing for other publications, you can naturally reference competitive insights and link back to your chart as a valuable, non-promotional resource for their audience.

- Email Nurturing: Drop the chart into your lead nurturing sequences, especially for prospects who have shown interest in competitive content. A simple, direct email with the subject line "How we're different" can be incredibly effective.

The real magic happens when you arm your sales team with the chart. It becomes their go-to resource for objection handling. When a prospect says, "But Competitor X does this," your team can pull it up and walk them through the specific value you provide, backed by facts.

Empower Your Sales Team to Close Deals

The sales team is on the front lines, and your comparison chart is one of the most powerful weapons you can give them. It's a visual, data-backed tool that helps them navigate tricky conversations and reinforce your product's unique value proposition with confidence.

This is especially critical in fast-moving industries like artificial intelligence, where new competitors and features pop up constantly. The AI market is projected to surge from $757.58 billion to $3.68 trillion by 2034, with North America currently holding a 36.92% share.

In such a dynamic environment, having a clear comparison chart helps your sales team cut through the noise and demonstrate undeniable value. To see just how fast this space is moving, check out these insights on the rapidly growing global AI market. By equipping your team with this tool, you enable them to handle objections with facts, not just opinions, ultimately shortening the sales cycle.

Frequently Asked Questions

Even with the best game plan, a few questions always pop up when you're in the thick of building a competitive comparison chart. Let's tackle some of the most common ones I hear from SaaS teams.

How Often Should I Update My Comparison Chart?

You should plan for a deep, comprehensive review every quarter, with a quick check-in once a month.

The SaaS world moves at lightning speed. Your competitors are constantly launching features, tweaking their pricing, or rolling out new messaging. A comparison chart that’s even a few months out of date can do more harm than good—it can make you look lazy and damage the trust you’re trying to build.

To keep this from falling through the cracks, just set a recurring reminder on your calendar. A quick monthly scan of your top competitors' websites is usually all it takes to spot any major changes.

What If a Competitor Is Better in One Area?

First off, don't panic. And whatever you do, don't lie or try to spin it. Honesty is your biggest asset here. Trying to hide a competitor's strength is a quick way to lose all credibility.

You've got two solid options when this happens:

- Frame it honestly. You can acknowledge their advantage but give it context. For example, you could list their advanced reporting feature as "Advanced, for enterprise teams," which subtly qualifies it for a specific (and maybe not your target) audience.

- Leave it out. If the feature they excel at isn't a core decision-driver for your ideal customer, you can simply exclude that row from the chart. Focus on the features that matter most to your buyers.

The goal isn't to win every single checkbox battle. It's to prove you are the best overall solution for your specific target audience. Acknowledging a competitor's niche strength can actually make your own advantages seem far more believable.

Should I Include Pricing in the Chart?

Yes, but only if your pricing is a clear competitive advantage.

If you have a simple, transparent pricing model and your main competitor is known for a complex, confusing one, then absolutely put it in the chart. Highlighting that clarity can be a massive selling point.

But be careful. If your pricing is usage-based or highly variable, trying to force an apples-to-apples comparison can easily backfire and create confusion. In that scenario, it's much smarter to use general terms like "Flexible Tiers" or "Usage-Based" and link people directly to your pricing page for the nitty-gritty details.

At Pages.Report, we analyze what makes top SaaS landing pages convert, so you don't have to. Learn from over 368 successful products and apply proven design patterns to your own pages. Start building landing pages that close deals at https://pages.report.